📈 East Palo Alto's Property Tax Advantage and the Urgency of Development

City's Share of Property Tax Revenue

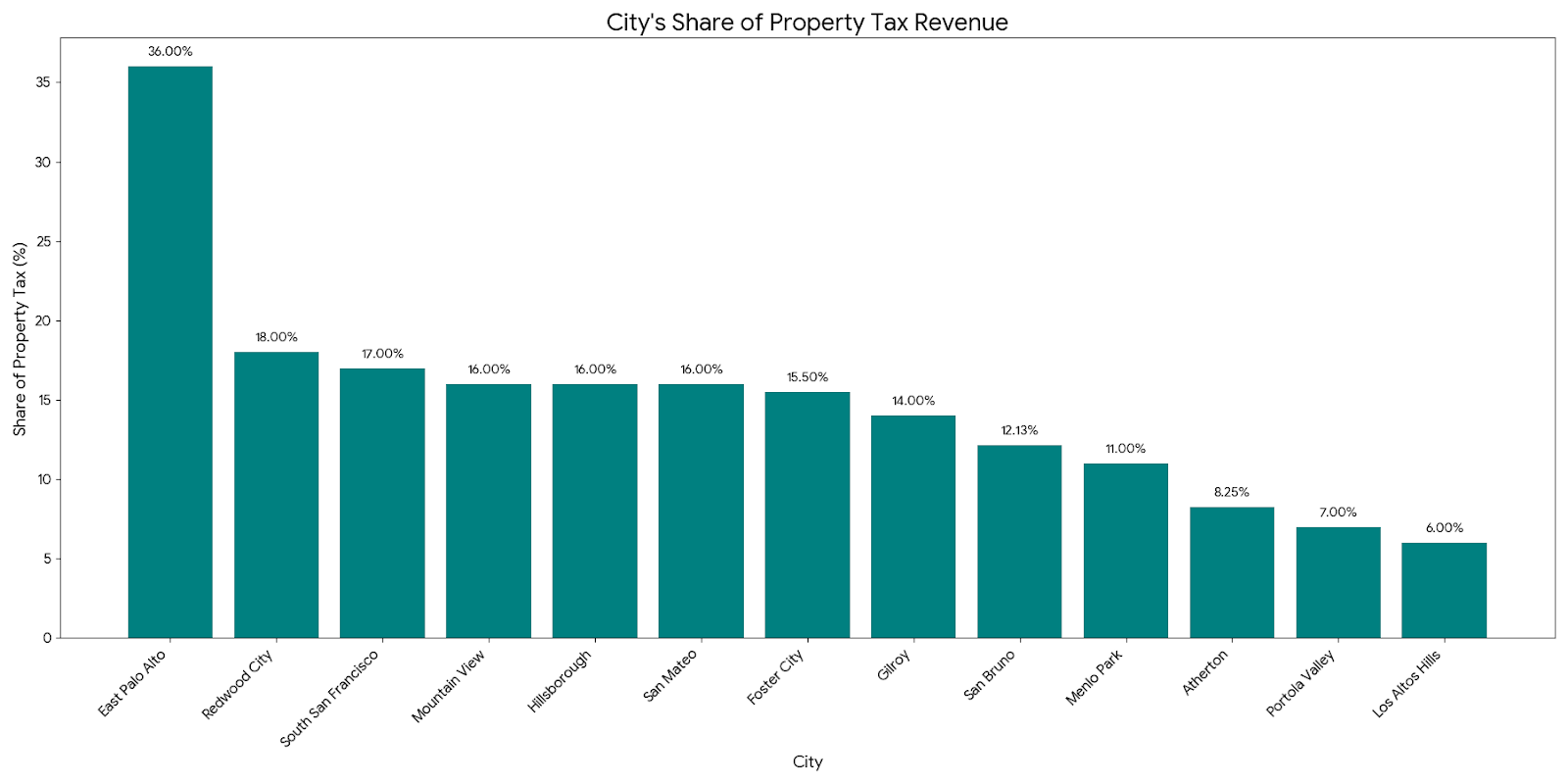

The bar chart above visualizes the property tax revenue share for each city, sorted from highest to lowest percentage.

| City | Share (%) |

| East Palo Alto | 36.00 |

| Redwood City | 18.00 |

| South San Francisco | 17.00 |

| Mountain View | 16.00 |

| Hillsborough | 16.00 |

| San Mateo | 16.00 |

| Foster City | 15.50 |

| Burlingame | 15.00 |

| Gilroy | 14.00 |

| San Bruno | 12.13 |

| Menlo Park | 11.00 |

| Atherton | 8.25 |

| Portola Valley | 7.00 |

| Los Altos Hills | 6.00 |

When East Palo Alto (EPA) incorporated in 1983, it was established with a crucial financial advantage: the State and County allocated it roughly double the property tax share given to other cities. This higher percentage was deemed necessary for the city to be financially viable and provide even the most basic services.

Currently, EPA benefits from an exceptional property tax allocation:

- The City of East Palo Alto receives 33% of the property tax revenue.

- The East Palo Alto Sanitary District receives an additional 3%.

This combined share is a powerful economic tool, and it creates a massive incentive for smart development.

🏗️ Fueling the General Fund and Improving Quality of Life

Taxes generated from new development—especially market-rate projects—flow directly into the city's General Fund. This critical fund is the primary source for essential municipal services that make a city thrive:

- Infrastructure: Roads, lighting, water, and sewer systems.

- Public Amenities: Parks and a new library.

- Operations: City staff salaries, police, fire, and other administrative costs.

For example, the Sobrato/Amazon building on University Avenue pays over $700,000 annually in property taxes. This single contribution demonstrates the significant revenue potential of commercial development.

💡 The Vision: Encouraging Growth for Better Services

We must do everything possible to encourage development, particularly on underutilized properties or empty lots that currently contribute nothing but visual blight.

The right kind of development provides a dual benefit:

- Direct Needs: It brings desired amenities like new housing, grocery stores, and restaurants.

- Increased Tax Base: It permanently boosts the tax base, ensuring a stable, growing source of revenue.

A robust tax base is the key to delivering better services for all residents and building significantly improved city infrastructure. Investing in development is investing in the long-term quality of life in East Palo Alto.